Financial sector sees growth oppertunities as the Fed eases interest rates

Financial sector sees growth oppertunities as the Fed eases interest rates

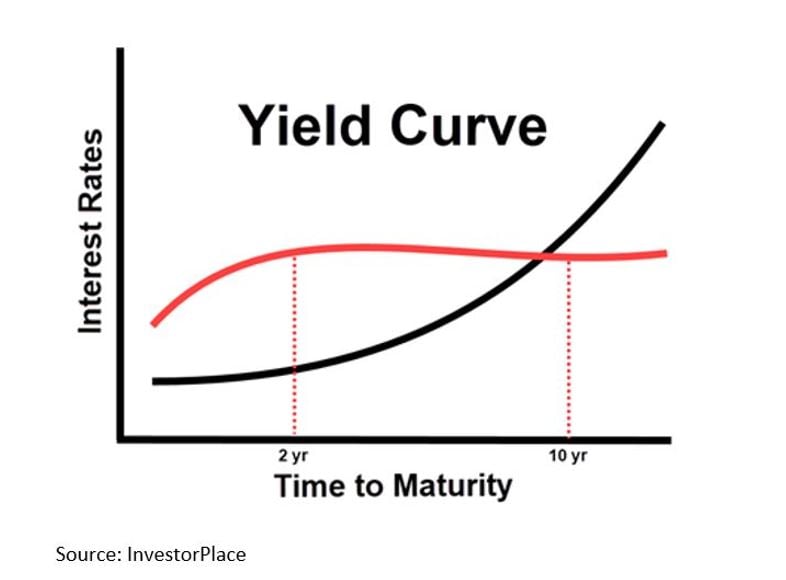

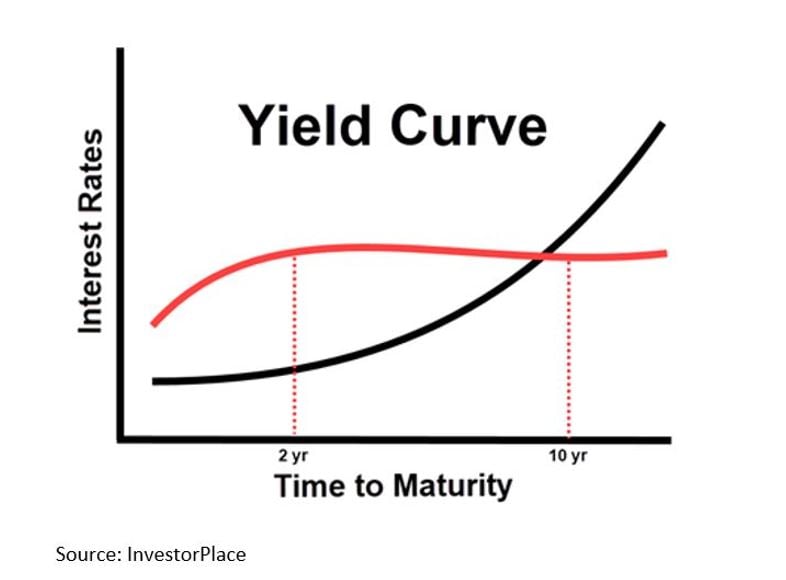

Banks are uniquely positioned to capitalize on a steepening yield curve. They typically borrow at short-term rates and lend at long-term rates, profiting from the spread known as net interest margin. When long-term rates rise faster than short-term ones, that margin widens — especially for new loans — boosting profitability.

This environment acts as a tailwind for banks, supporting revenue growth and stronger earnings. With improved margins and rising loan demand, financial institutions — particularly large-cap banks — could see meaningful upside.